do you pay taxes when you sell a used car

The short answer is maybe. A taxable gain occurs when something sells for more than its cost basis.

I Want To Sell My Car But I Still Owe Money News Cars Com

The sales tax on a new car might be 5.

. Thus you have to pay. New South Wales Across the border from the ACT stamp duty is based on the higher of either the price paid for the vehicle. In most cases you do not have to pay any taxes when you sell your car to a private seller or a company like The Car Depot.

When you trade in a vehicle instead of paying tax on the full value of the new car you are taxed based on the difference in value between the trade-in and the new vehicle. However you do not pay that tax to the car dealer or individual selling the. Typically most states charge between 5 and 9 for their sales tax says Ronald Montoya senior consumer advice editor at Edmunds.

There are some circumstances where you must pay taxes on a car sale. If the dealer offers you 25000 for it you now owe the dealer the 20000 balance for the new car. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax.

Most car sales involve a vehicle that you bought new and are. So if your used vehicle costs 20000. Selling a car for more than you have invested in it is considered a capital gain.

Answer 1 of 5. In this scenario Florida will collect six percent sales tax on 31000 which is the advertised price of. Although a car is considered a capital asset when you originally purchase it both state.

Its very unusual for a used car sale to be a taxable event. You also want to trade in your old car. When you sell a car for more than it is worth you do have to pay taxes.

That means youll be taxed only on. You likely paid a considerable amount of. How much tax do you pay when you sell a car.

Ultimately you pay 28000 for the car saving 12000 off the original price. In case you were wondering 742 of 37851 is around 2808. In addition to the above sales tax can also be charged on a county or municipal level.

How Does The Electric Car Tax Credit Work U S News

How To Save On Taxes When Buying And Selling A Car In Ohio Progressive Chevrolet

If I Buy A Car In Another State Where Do I Pay Sales Tax

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

Do I Need To Pay Taxes On Private Sales Transactions Rocket Lawyer

How Does Trading In A Car Work U S News

Car Leasing Return Lease Return Vs Selling A Lease Car Edmunds

How To Buy A Car Out Of State Nextadvisor With Time

Should I Buy A Car From Carmax Rategenius

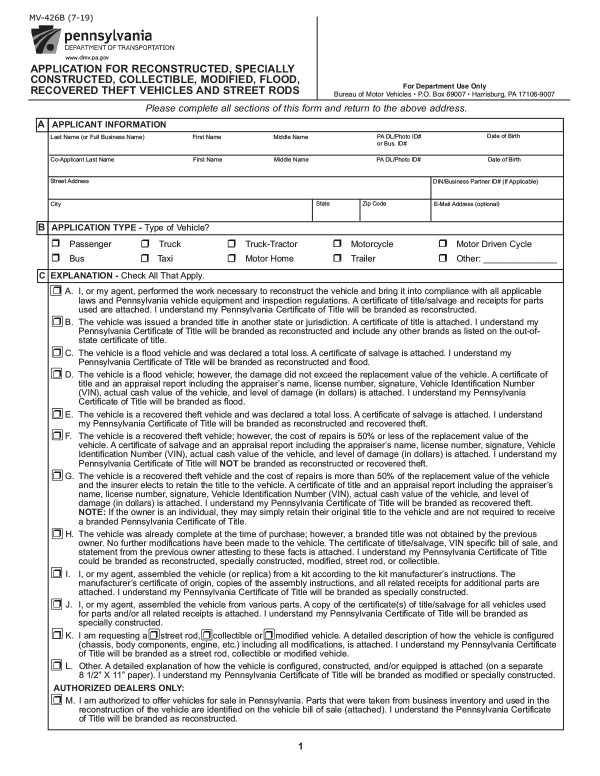

Bills Of Sale In Pennsylvania All About Pa Forms And Facts You Need

Taxes When Buying Or Selling Cars At Thompson Sales

Buying A Car Without A Title What You Should Know Experian

Is It Considered Income If I Sell My Car The News Wheel

Car Financing Are Taxes And Fees Included Autotrader

Free Motor Vehicle Dmv Bill Of Sale Form Word Pdf Eforms

Why Should I Have To Pay Taxes On A Used Car The Globe And Mail

Do You Pay Taxes On Investments What You Need To Know Turbotax Tax Tips Videos

/GettyImages-160143914-490a0fd99380456fb809d575104c4719.jpg)